As I noted on Monday, the world has been betting against the U.S. Dollar.

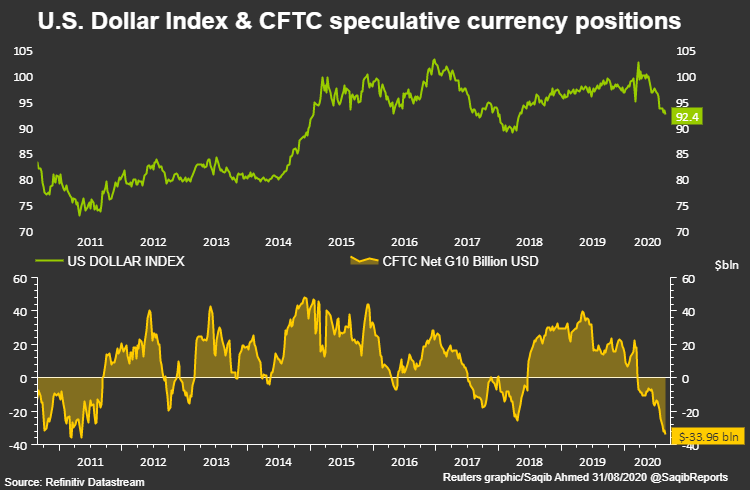

This chart by Ahmed Saqib says it all.

The breakdown of the Commitment of Traders Report from the end of August shows that hedge funds had been shorting the U.S. dollar into the ground.

Hedge funds were net short against the U.S. dollar to the tune of $33.96 billion at the end of the month.

That was the largest net short position in nine years. This was back when there was increasing concern about a government shutdown that would pulverize the dollar.

The greenback was off more than 11% for the year compared to a broad basket of currencies that included the Euro, the Pound, the Aussie dollar, and the Yen.

The longer-term outlook for the dollar is incredibly uncertain in the era of COVID. However, I’m not interested in playing the long game right now. I’m looking for a sharp upward move in the dollar that no one seems to believe is possible in the month ahead.

I’m willing to wager $15 on an options contract if it can pay 10 to 1 but appears to be positioned at odds closer to 3 to 1.

You do not need to be a currency expert to look at the chart above and read the Commitment of Traders Report to see a crowded trade.

But if you’re a contrarian who understands crowded trades and pairs that trade against very low implied volatility you can discover a massive money-making opportunity.

On Monday I discussed a trade on the Invesco DB US Dollar Index Bullish Fund (NYSE: UUP), which tracks “the price movement of the U.S. dollar against a basket of currencies, including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona.”

I recommended investors take a look at October 23 $25.50 calls at a limit of up to $0.15. This has an implied vol of just 7.5.

That low vol signals that the market doesn’t anticipate a shift in the U.S. dollar in the weeks ahead. However, a sharp move is possible, and this trade is what I’m tracking right now as the latest Black Swan move that we want to profit from.

Trading the Dollar Before the Election

This week, we’ve seen some big downward moves in gold, silver, and other commodities and an uptick in the dollar against that basket.

On Wednesday, gold prices fell back under $1,900. Silver was off more than 4%. The kiwi and Australian dollar are off due a lower rate outlook. The euro and pound are sliding against the dollar due to weak economic outlooks and the rise of COVID once again across the continent.

This trade is simply focusing on the relative value of the dollar against this other basket of currencies. I’m not focusing at all on the nominal value of the dollar.

We only want to be the cleanest shirt in a very messy and muddy laundry basket.

This week, we’ve seen moves that signal an uptick in hedge funds covering those net short positions. So far this month, the net short figure has declined from over $30 billion to around $25 billion.

Now, we’ll keep a very close eye on Friday’s Commitment of Traders report. If we see a significant amount of short covering on the dollar, this trade will return at least 100% in a week.

If we hit a 100% return, it’s best to sell half of the position and let the rest of it ride for maximum upside.

Until then,

-G-