The insider buying numbers are awful right now.

Most insiders at U.S. corporations have kept their checkbooks in their pockets and have no interest in increasing their ownership in the companies they run.

Sellers, on the other hand, are out in droves selling stock at a furious pace. They know that valuations are elevated, and this could be the best opportunity to cash in for a long time.

The ratio of sellers of buyers to sellers is as low as I have seen it.

The intriguing aspect for me is: although there are very few insiders buying stock, there are a few.

More importantly, we know from the study Trading Against the Grain: Why Insiders Buy High and Sell Low that insiders, as a rule, prefer to buy shares close to 52-week lows. They have a tendency to be bargain shoppers, if you will.

But occasionally we see insiders buying even as stocks close in on and surpass 52-week highs. Insiders who buy near the highs usually have some sort of very positive non-public information. The returns to these insiders are enormous, according to the study.

My own research confirms that insider buying near the highs often leads to high excess returns.

When I see insider buying in a stock near the highs during a period of time when stocks are ripping higher, I want to know what’s going on at the company.

Should I jump on board in anticipation of a big move?

Right now there are two companies where insiders continue to buy even though the company is at 52-week highs.

Let’s take a look…

Two Insiders Betting Big on Soda

Keurig Dr. Pepper (KDP) has seen two insiders buying shares even as the stock closed in on news highs. The company makes soda and coffee products, so it’s not like they have discovered the cure for cancer or some hot new technology.

Is the much-lamented Dr. Pepper shortage almost over?

Is the reopening of the economy going to give an enormous boost to their soda products’ restaurant and hospitality sales?

Two insiders like what they see in the future enough to have spent $800,000 between them last week to buy more shares of the company.

I also noticed that BDT Oak Acquisition added to its stake in Keurig Dr. Pepper in the last quarter of 2020. While that was done at lower prices than the current quote, the fund is managed by Byron Trott’s BDT Capital.

Trott is a former partner at Goldman Sachs and is best known as the man Warren Buffett once said was the only banker he trusted.

There are several people with in-depth knowledge and understanding of Keurig Dr. Peppers’s condition and prospects that have been buying stock well above the 52-week lows.

This Boring Company’s Insider Continues to Buy

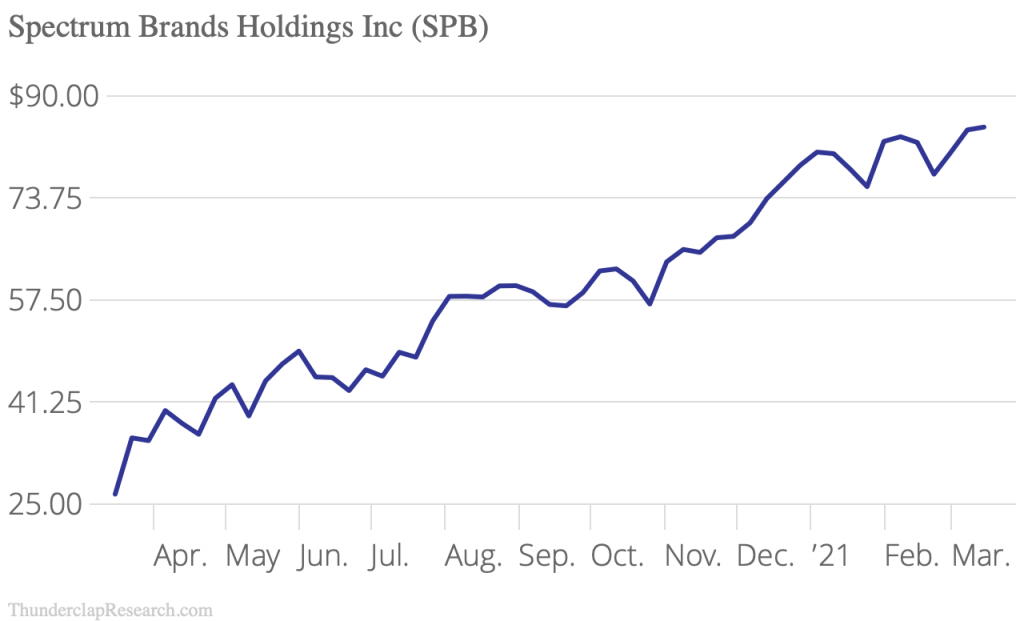

Why is the CEO and Executive Chairman of Spectrum Brands (SPB) buying more shares in his company?

Not only did David Maura buy almost $200,000 worth of stock in the company he runs, but he also exercised options in December and held onto the shares.

Spectrum isn’t sending crews into space or developing electric vehicles.

They own companies that make door locks, toilets, George Foreman Grills, and dog food.

Spectrum is a fantastic collection of brands, including Black and Decker, Kwikset, Hotshot, Cutter, Black Flag, Remington, and many other products we all use all the time.

But what made Mr. Maura decide last week that this was the time to spend some cash to increase his stake in the company?

Is the economic recovery going to add that much to the business over the next year?

It is worth noting that analysts seem to think so as they have been raising their revenue and earnings estimates for 2021 and 2022 in recent months.

That’s not a surprise when you consider that Spectrum has posted four consecutive positive earnings surprises over the past year.

The stock is up more than 50% over the past year, so Mr. Maura must really have positive expectations for this collection of businesses over the next few years.

Insiders do not buy for small moves in the stock price. They are accumulating stock for massive long-term gains.

When they buy near 52-week highs, the research indicates that there may be non-public information that leads them to believe those massive gains are coming sooner than most people expect.

Insider buying near 52-week highs contains valuable information.

Insiders buying near highs in a market making a big up move is even more intriguing.